Talking Point: Where next for UK equities?

As Brexit draws closer, what do

analysts anticipate for UK equities?

'Invest in what you know': this is a well-known totem which has served many investors well for many decades.

But if what you know is only a handful of domestic equities, and this occupies the lion's share of your portfolio: are you really playing it safe, or taking a big risk?

Investors plying everything into the domestic market - in this case, UK equities - could be accused of putting themselves in a position of risk.

After all, they already have a high exposure to their home economy: their job, their income, their house, their bank account, their mortgage and their pension are all likely to be in the UK and valued in sterling.

Why, then, would UK equities make up the majority of their investment portfolio, when there is a whole world of stocks and shares from which to choose?

Then again, given that UK economic growth figures have been depressed significantly, thanks in part to Covid-19 and in part to Brexit, how can investors make sense of which UK stocks might be a good long-term investment choice, and which ones will not stay the course?

Choice comes down to it: most investors do not have the time to pick stocks or even choose fund managers. How, then, can they make the right decisions about whether to stay or leave the UK?

And if they do sell, are they merely crystallising their losses and potentially missing out on an eventual rebound?

This is why getting good investment advice is so important: when the FTSE 100 has fallen from its giddy heights of 7,600 and more at the start of 2020, down to trading around 5,800 as at the end of October, what should investors know and what decisions should they be making?

Providing a well-diversified investment portfolio for a client does not mean ditching the UK altogether - but it does mean being selective about the funds and stocks within a portfolio and finding those diamonds sparkling among the London Stock Exchange listings.

Analysts who scour the markets daily will tell you there are great UK investment opportunities to be found despite the gloomy headlines and the prospects of strong economic headwinds.

This report aims to highlight some of those bright spots in the UK market and showcase what sort of investment strategies will work well for an equity market that appears to be very much unloved at the moment.

simoney.kyriakou@ft.com

The outcome of the ongoing Brexit negotiations are not a major consideration for advisers when assessing their client’s exposure to UK equities, according to the latest FTAdviser poll.

The poll showed that while advisers are almost evenly split on whether they are positive about the outlook for the UK market in the year ahead, Brexit is a defining issue for less than a third of those polled.

The data shows that 37 per cent of advisers are likely to increase their exposure to UK equities in the year ahead, while 33 per cent do not expect to. 29 per cent say their exposure to the UK will depend on the result of the Brexit process.

The FTSE 100 tends to have an inverse relationship with good Brexit news, that is, it falls when the market believes a deal is happening.

This is because a deal would cause the value of sterling to rise, and the bulk of the corporate earnings in the FTSE 100 are generated in overseas currencies. The value of those earnings is lower if sterling is rising in value against the currency in which those earnings have been generated, making the share prices potentially less attractive.

In the immediate aftermath of the Brexit vote in 2016, sterling fell sharply, but the FTSE 100 performed strongly.

david.thorpe@ft.com

REUTERS/Peter Nicholls

REUTERS/Peter Nicholls

What is there to love about the UK market?

The UK is currently a friendless market — unloved, underperforming and facing a perfect storm of headwinds that instil little confidence to cautious consumers.

Uncertainty over Brexit, the country’s arguably poor handling of the coronavirus crisis, the subsequent dividend drought and the UK’s exposure to unpopular sectors have left the region with an uphill struggle.

Data from the Investment Association shows investors have felt the pinch and voted with their feet. More than £1.5bn was pulled from funds in UK sectors from May to July, in the same months that £2.5bn was plunged into global funds.

Tom Becket, chief investment officer at Psigma, says: “It’s basically a perfect storm for UK equities.

“The UK’s significant sectors are under pressure, we don’t have much exposure to the sectors doing well. And then combine all that with the Brexit situation and the fact there is not a huge confidence in the domestic political and Covid-19 situation.”

And the UK has lagged other markets, particularly in the aftermath of the coronavirus-induced market crashes.

Some major markets — such as the S&P 500, the Nikkei 225 and China’s SSE Composite Index — are up year-to-date, with the US blue chip index climbing 56 per cent since March.

It’s basically a perfect storm for UK equities.

Meanwhile, the UK has struggled to recoup its initial pandemic losses. The FTSE 100 is down 22 per cent since the start of 2020, having only recovered 18 per cent since global markets tumbled mid-March.

Jason Broomer, investment director at Square Mile, says the UK was in an “unfortunate place” at the moment and with a number of factors “not going in it’s favour”.

He adds: “The UK is an unloved market. It has clearly been hit worse by the economic side of the pandemic and the GDP shrinkage is forecast to be the worst out of the major countries.”

Shortcoming sectors

The UK’s struggles can be understood by the sectors which underpin its market and economy.

Its service-driven economy has suffered as national lockdowns curbed domestic and international travel while curfews and social distancing rules have hamstrung the hospitality sector.

Financials and oil companies, both prevalent in the FTSE 100, are economically sensitive stocks, while the UK’s fame as a ‘dividend haven’ has been bruised amid the crisis.

Charlie Parker, managing director of Albemarle Street Partners, says the UK was home to “big victims of the virus”.

He says: “Retail, hospitality and in-person service sectors are in dire straits. In this context, anything staple is going to fare better than anything discretionary.”

Adrian Lowcock, head of personal investing at Willis Owen, agrees, pointing out that airlines, hotels, cinemas, restaurants and pubs had seen the “majority of their business dry up for much of 2020”.

He adds: “The oil and gas industry has also suffered as the oil price collapsed and demand has shrivelled up and dividends were slashed.”

The price of oil has been on a decline since the start of the year, tumbling 36 per cent since January 1 and hurting big UK oil stocks such as BP and Shell.

At the end of March, the price of oil hit an 18-year low when Brent Crude Oil — the international benchmark oil price — fell to $21.76 (£17.68), the lowest since 2002.

On top of this, the UK’s attractiveness as a ‘dividend haven’ wilted when companies began slashing their payouts amid the crisis, with about 40 per cent of dividends scrapped.

For the UK market, major blows came when the biggest banks and insurers ditched their payments for the rest of the year following pressure from the Bank of England to maintain a cash buffer to help them through the coronavirus crisis.

But it was not all doom and gloom, with some managers positive about the future of certain UK sectors.

Jean Roche, co-manager of the Schroder UK Mid Cap Fund, says: “The consumer has led the way in the recovery, and therefore the outlook for responsive and forward-looking consumer facing companies operating in niches which are performing well, is bright.

“In sectors such as leisure, capacity exiting the market will mean that the survivors are in a very strong position, though this may take some time to play out.”

For Will Hobbs, chief investment officer at Barclays Wealth and Investments, the UK economy faces its challenges in a “far better position than was feared only a few months ago”.

He adds: “This pandemic has ushered the world a few further steps into the so-called fourth industrial revolution.

“How effectively we disseminate, and adapt to, the productive marvels that will perhaps emerge from this next revolution will obviously have a major bearing on the outlook for the years ahead.”

The epitome of a value play

Experts were generally optimistic about the future of investing in the UK, primarily arguing that its stocks were undervalued and could therefore offer good returns following any global economic recovery.

Simon Evan-Cook, fund manager at Premier Miton, says: “Yes, on a ‘macro’ basis the picture looks cloudy at best, with the pandemic an area of concern, mixed in with the other great unknown of Brexit.

“But these are well-known factors, and are the reason that UK equities are good value today.

“Anything less than an unexpected disaster on either front and we think there’s a decent chance the market will react well.”

Ben Yearsley, investment consultant at Fairview Investing, agrees, adding that the market would “fly” against a backdrop of a Covid-19 vaccine and a Brexit deal.

He says: “The UK is cheap on most measures, partly down to Covid and partly down to Brexit. And sterling is cheap too.”

Mr Becket describes the UK as the “epitome of a value play”.

As value funds and shares – which put more of an emphasis on the price paid for a stock rather than the near-term earnings growth prospects of a company – typically perform better when inflation and interest rates are rising and economic growth is strong, the strategy has been out of favour for more than a decade.

This pandemic has ushered the world a few further steps into the so-called fourth industrial revolution.

But buying companies currently “unloved” at low share prices mean the returns can be much greater when, or if, the tides turn.

Mr Becket says: “The UK could well be the best way to play the global re-opening. All the key components to make it an obvious contrarian opportunity are in place.”

Mr Parker agrees, saying the cheapness of the UK market meant he had an expected annual return of 7 per cent on the UK over the next five years compared to 4.4 per cent for the United States. He adds: “However, this opportunity will require delicate timing.”

Where to look

Getting access to the UK economy is not as simple as buying a FTSE tracker, experts were quick to point out.

Mr Hobbs says: “The large-cap equity sector dances mainly to the tune of factors outside of this economy. The smaller in size you go, the more of the footprint of the UK economy you are likely to find.”

FTSE 100 companies derive approximately two-thirds, or around 70 per cent, of revenues from overseas, while the FTSE 250 has more of a 50/50 split.

The outcome of Brexit trade negotiations is set to play a key part in how different sized companies perform in the coming years, as the pound’s movements impact the indices in opposite ways.

Mr Parker says: “A successful resolution would boost sterling and support medium-sized companies [...] while large-caps could be hampered by a sterling recovery.

“In this context we are sticking to quality and growth exposure in the UK and holding only modest positions in UK value.”

There are other reasons to gain exposure to the small and mid-cap parts of the UK economy, with an accelerating mergers and acquisitions trend set to boost SME returns.

In fact, research indicates that on average, almost 6 per cent of companies in the UK’s SME indices are acquired each year.

Mr Roche says: “This is one of the reasons these indices outperform larger company indices over time. So it could be beneficial for investors to have some exposure to these indices.”

Mr Becket agrees, adding: “We know the world is sitting on a huge amount of money both in the form of asset managers and on the venture capital side so the UK could benefit from significant trends in M&A.”

In terms of active versus passive, it is often argued that investors gain more from active management in less efficient and less prosperous markets — such as the UK’s current position.

The UK’s value-heavy bias means indices are unlikely to outperform until there is a revival of value stocks, but active managers are (sometimes) able to pick the winners from the losers.

Mr Evan-Cook says: “Within the market, there are plenty of value and growth stocks for active fund managers to choose from.

“We think the current conditions, having been driven by both extreme fear and greed, give genuinely active managers a lot of great opportunities to choose from.”

In this context we are sticking to quality and growth exposure in the UK

For Mr Lowcock, a trio of funds hit all the right UK spots. He suggested the Man GLG Undervalued Assets fund for offering exposure to any value recovery, claiming that manager Henry Dixon could “move swiftly to exit value traps”.

Columbia Threadneedle’s UK Equity Income was a “core holding” for exposure to UK dividends, Mr Lowcock said, while Dan Nichols’ Merian UK Smaller Companies provided access to growth companies in the UK small-cap space.

Mr Yearsley promoted the Montanaro UK Smaller Companies trust. He said: “I still like buying small and mid caps as they tend to be less of a value trap, have more growth prospects and are still cheap.

“So something like Montanaro UK smaller companies trust is ideal.”

But Mr Hobbs suggested casting an investment net “a little wider” than the recent winning sectors and asset classes to plan for a “relatively unpredictable” future.

He said: “It would hardly be a stretch to imagine the decade ahead looking quite different from the decade just gone for example.

“To that end, the types of investments – styles, regions, sectors – that you need to bring to bear in the decade ahead may also look quite different, to plan for a future that isn’t just a continuation of the recent past.”

imogen.tew@ft.com

House View: The 'homebody economy' – investing in your digital back yard

Covid-19 has accelerated existing trends to shop, study, work and play at home with important implications for investors in UK equities.

It is clear that UK shares are unloved. No likes, no shares, no new friend requests. The level of gloom surrounding this market is remarkable even amongst UK based investors, who, you might think, should feel more comfortable investing here.

This is not just pandemic queasiness. Although the UK economy is service-led to some extent, it is not uniquely disadvantaged by the fallout effects of Covid-19.

And indeed, the government’s support schemes such as Eat Out to Help Out have focused on supporting the more vulnerable services element of the economy.

Should we blame Brexit? Last year, we saw a similar spell of despondency when international investors shunned British shares ahead of the withdrawal deadline. Once they realised the world wouldn’t end, UK mid-caps bounced back very strongly.

We’re back there again. Global fund managers are at their gloomiest, in terms of an underweight to UK equities, in two years, according to the most recent update of a monthly survey by Bank of America.

There’s no guarantee history will repeat itself. But it seems reasonable to assume that current fears will subside as the usual brinkmanship around EU negotiations results in an agreement of sorts, and that UK share prices will rally.

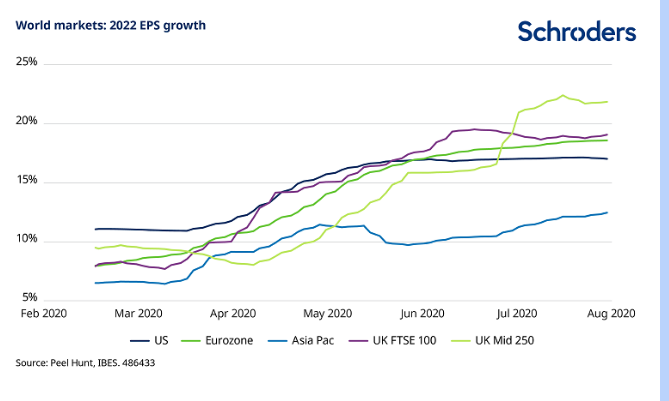

One chart, from Peel Hunt, captures the story from a different angle. It shows analysts’ consensus for increases in earnings per share for certain markets. The FTSE 250 is forecast to recover with more gusto than other major markets, shown below.

Obviously, the forecasts included should not be relied upon, are not guaranteed and are provided as at the date of issue. Forecasts and assumptions may be affected by external factors and are subject to change.

Valuations are also worth considering. UK small and medium-sized stocks trade at a discount of around 25 per cent to similar stocks globally, based on a blend of valuation yardsticks including price-to-earnings and price-to-book.

Regardless of whether confidence returns, we’re focused on a certain characteristic of the market – the “homebody economy”.

Why the “homebody economy” is flourishing

The term will be familiar to those in the US; less so elsewhere. It is the increased shopping, studying, working and entertainment we’ve all been doing at home during lockdown.

“Homebody” is no longer considered a derogatory word; it reflects a trend that’s widespread, growing, and a force to be reckoned with. Most importantly, you can get plenty of exposure to it in the UK, through underappreciated technology or technology-enabled growth companies, and their enablers.

In my world, as an investor focused largely on medium-sized FTSE 250 companies, or mid-cap, I see industries and sectors that are firmly in this space.

Global fund managers are at their gloomiest, in terms of an underweight to UK equities, in two years

You will have noticed these trends yourself – the boom in pet ownership, for instance, thanks to the likely new normal of two or three days a week working from home. This shift in pet ownership has been a boon to Pets at Home, an out-of-town superstore for pet owners.

The increase in gaming has also been widely reported. With non-existent commutes and more time available at home, many people are spending more of their wages on entertainment. It’s not just desktop gaming either: table-top gaming has flourished too.

The likes of Warhammer, a table strategy game previously associated with pre-teen boys, has seen demand soar. Its owner, The Games Workshop, has reaped the benefits.

Refurbishment is another trend that may resonate with anyone who has sat at home long enough to notice the rooms in dire need of a makeover. As a result, retail park-based companies such as DFS, a furniture chain, and Dunelm, a specialist in affordable and well merchandised homewares and furnishings, have seen demand rise.

All this increased working from home is only made possible by good connectivity and reliable “kit” however. Homeworkers are at the whim of technology, so companies providing infrastructure and support have naturally thrived amid the homebody digital economic boom.

Examples include under-appreciated UK tech companies such as Computacenter (which seems to keep upgrading its earnings forecasts) and Softcat.

Other trends are less obvious. The increase in stock market trading has been helpful to online trading companies. This is the result of a section of the population, having more time (and privacy) to dabble, more money after saving on travel costs, and the inspiration of a breathless rally for high-profile stocks, such as Apple, Amazon and Tesla.

Digitally advanced UK online financial spread betting companies IG Group and CMC Markets, for example, have significantly expanded their audiences.

And what of office stocks? Well, these can also benefit from an increasingly digital world. IWG, the largest flexible office space platform, is well placed to respond to what is likely to be a rapidly evolving backdrop, with employees mixing and matching working from home alongside collaboration sessions in the office.

Much rests on which of these trends hold. The government has told us to go back to the office. But changes which were already happening have been accelerated by the pandemic.

The shrewd investor must judge the extent to which they will persist. Only then does assessing the long term winners and losers become possible.

Jean Roche is co-fund manager of the Schroder UK Mid Cap Fund

Photo: Oleg Magni via Pexels

Photo: Oleg Magni via Pexels

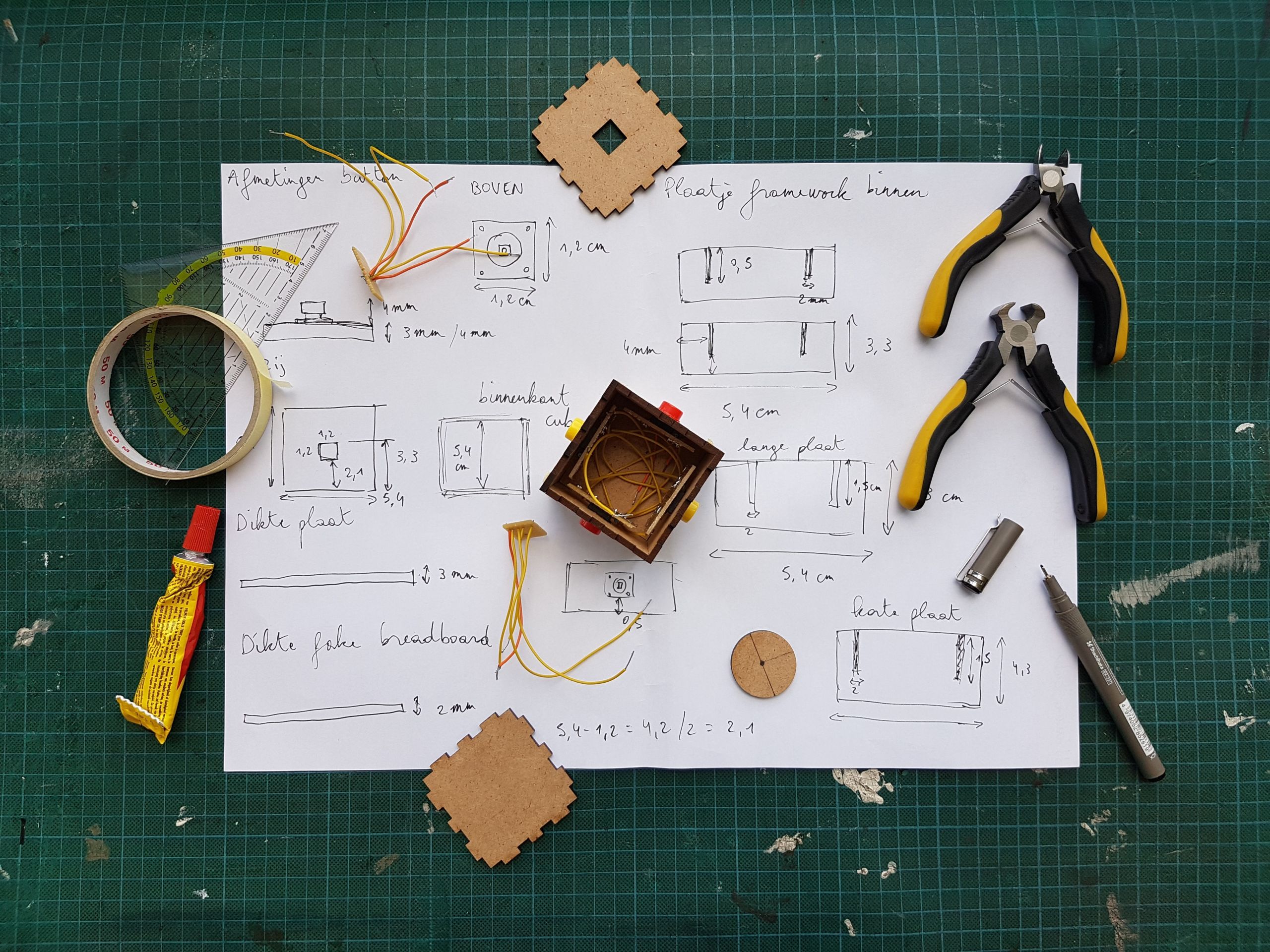

DIY projects have boosted the fortunes of certain companies during lockdown. Photo: Senne Hoekman via Pexels

DIY projects have boosted the fortunes of certain companies during lockdown. Photo: Senne Hoekman via Pexels

What effect will Brexit have on UK stocks? Photo by Anthony Beck via Pexels

What effect will Brexit have on UK stocks? Photo by Anthony Beck via Pexels